The Access to Capital brief lays out the ability of farmers and food businesses to find and acquire financial resources, such as loans, grants, or other investments, in support of long term viability of their businesses. This Issue brief is one of 27 briefs created as part of the NH Food and Agriculture Strategic Plan.

What's at Stake?

Granite Staters are reliant on the global food supply chain for over 90% of their food.1 When the global food supply chain is disrupted from extreme weather disasters, geopolitical forces, economic issues, workforce deficiencies, and other issues, shortages of food occur and put residents at risk.2 A reason for New Hampshire’s reliance on the global food supply chain: limited start-up financing for food producers is restrictive, leaving many local fishermen and food entrepreneurs without access to capital.3 For decades, access to capital for the agriculture, seafood, and food production industries in New Hampshire has been offered by only a few lenders, due to the inherent risk and lack of understanding of these industries.

Current Conditions: Financing Farmland & Farms

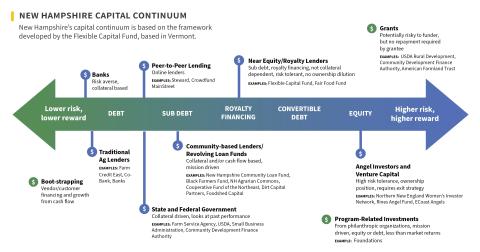

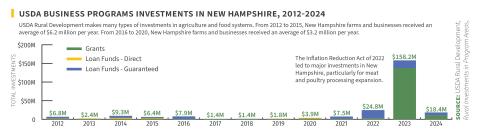

Farmers, fishermen, and food producers can access capital through several sources: federal funding (direct or indirect), lenders, nonprofits, private investors, and crowdfunding. The average direct USDA federal funding for New Hampshire producers between 2022-2024 totaled over $12.7 million.4

Financiers recognize the need to shift their approaches to better support the unique financing needs of farms, such as tailoring loan structures, flexible terms, and building capital stacks with public and private sources. However, the majority of financiers have continued business as usual; offering terms that negatively impact affordability and a farm’s ability to maintain positive cash flow.

Furthermore, there are limited assets available for match funding for federal or state grants and limited collateral requirements beyond farmland; often loan structuring deals are extractive to the personal wealth of farmers and food producers. Financiers need to increase education to farmers, as most farm borrowers do not understand how the relationship between the right capital, at the right time, with the right structure and provider, can impact their business.

Challenges & Opportunities: Financing Farmland & Farms

Challenges

> Loan underwriting criteria follows strict requirements, including regulations, lender’s policy, and low leverage loans, etc. This needs to be reworked to support entrepreneurs who historically have not had access to most sources of capital.

> There is a need for lenders to better balance risk, profit, and impact in a way that benefits food and farm borrowers or the community.

> Funding from government and philanthropic entities presents challenges, such as short-term programs, fund management, high reporting requirements, limited funding in certain locations, etc.

> There is not enough flexible capital to offer very low interest loans and/or forgivable loans for early stage businesses and start-up funding.

Opportunities

> In late 2024, the USDA’s Farm Service Agency rolled out new lending policies that allow for greater flexibility for their loan programs (i.e., three years of interest only).

> Expanding current, university-led research and communications to educate Granite Staters about the community, economic, health, and social contribution of the food system will support proactive policy, such as tax exemptions and abatements or start-up funds and incentives for farms.

> Some lenders are aware of on-farm climate solutions and practices that lead to healthy food production.

> Increase business and financial technical assistance and coaching from providers with farm and food business expertise, with funding to pay for these services.

Current Conditions: Financing Food Businesses

Typically, a food business sources capital through traditional main street lenders and online lenders. In the start-up phase, they may seek funding from private investors, crowdfunding (including from family and friends), and self-funding. There is limited federal funding, direct or indirect, for food businesses.

Borrowing from online lenders is not always in the best interest of a food business. For example, many business owners use a point-of-sale system for their business. Once a business reaches a steady sales level, the point-of-sale software evaluates the data and provides the business owner with a loan offer based on their payment volume and frequency. This offer is tempting to a business owner in a situation where an influx of fast cash seems like a good idea, and with a few keystrokes, a loan is secured, often with a higher loan rate and terms that may not be in the best interest of the business. Without proper financial management, a loan decision like this can stress daily cash flow even more and given the online nature of the loan, the important personal relationship between the lender and the business owner does not exist.

Challenges & Opportunities: Financing Food Businesses

Challenges

> Food businesses need more affordable funding for livable wages, equipment, facilities, and working capital for operations to ramp up or scale.

> Existing programs to support food businesses have room for improvement. For example, the USDA offers grants but the programs are complex and require upfront expenses from applicants, which is not conducive to aiding businesses.

> Service providers can improve their focus on coaching and guiding entrepreneurs, offering practical solutions rather than the personal biases that food entrepreneurs have experienced.

> Financing gaps exist for slower-growing, lower-margin food system businesses.

> Patient capital is needed; lenders and investors who do not specialize in the food sector lack understanding of the time it takes to break even.

Opportunities

> Advisory boards can support business owners with risk mitigation, access to markets, investors, and growth strategies.

> Business coaching providers, like Small Business Development Centers (SBDC), SCORE, and UNH Extension, exist and are available to provide support. However, they would benefit from greater understanding of the unique needs and challenges facing food businesses.

> Expanding current, university-led research and communications to educate Granite Staters about the community, economic, health, and social contribution of the food system will support proactive policy, such as tax exemptions and abatements or start-up funds and incentives for food businesses.

Summary

The opportunities identified in this brief either exist and need to be expanded or are being discussed and need to be acted on in the short-term. Lenders and other financiers focused on farm lending meet several times a year to un-silo and collaborate, but often question whether they have made enough impact to support long term farm viability. Service providers are limited and often overwhelmed in their ability to support the needs of farmers. Food businesses are often left out of the many opportunities available to farmers to get service provider support and governmental or non-profit grants.

Increasing the percentage of locally-produced food requires a whole system approach. This includes increasing flexible and patient capital, in combination with supportive policies and food business expertise for farmers and food producers. The recommendations layout key actions that can be accomplished with lenders, funders, investors, and governmental agencies working together, in collaboration with service providers and policy makers, to support farms and food businesses with equitable access to capital and economic security.

Recommendations

Organizations working on this issue

is an organization or program missing from this list? Let us know.

Authors

Lead Author

Charlene Andersen, Farm and Food Lender, New Hampshire Community Loan Fund

Contributing Authors

Joel Moyer, Director of Investments, Fair Food Network

Rebecca Davis, Farm Loan Manager, Farm Service Agency, United States Department of Agriculture

Ben Amsden, Initiative Lead, New Hampshire Charitable Foundation

Hannah Vargason, Senior Project Manager, Center for Impact Finance, Carsey School of Public Policy, University of New Hampshire

This brief was developed through a participatory process led by the NH Food Alliance, a program of the University of New Hampshire. The brief content is comprised of the opinions, perspectives, and information gathered by the authors and participants, and does not necessarily represent those of the NH Department of Agriculture, Markets, and Food or the NH Food Alliance.

Head to the NH Food and Agriculture Strategic Plan main page to read more briefs, browse recommendations and learn how the strategic plan was created.

References

1 Richardson, Scott. Harlow, Annie. Cardwell, Nicole. Porter, Katelyn. New Hampshire Local Food Count 2022. New England Feeding New England. Nefoodsystemplanners.org. Published September 2024. https://nefoodsystemplanners.org/wp-content/uploads/New-Hampshire-Local-Food-Count_2022.pdf

2 Hernandez, Jose. Grocery store shortages are back. Here are some of the reasons why. New Hampshire Public Radio. Nhpr.org. Published January 12, 2022. https://www.nhpr.org/2022-01-12/grocery-store-shortages-are-back-here-are-some-of-the-reasons-why

3 New England Food System Planners Partnership. New England Feeding New England. A Regional Approach to Food System Resilience: New Hampshire, State Brief. Nefoodsystemplanners.org. Published 2023. https://nefoodsystemplanners.org/wp-content/uploads/NEFNE-NEW-HAMPSHIRE-State-Brief.pdf

4 United States Department of Agriculture. Economic Research Service. Government payments by program. Usda.gov. Published 2024. Accessed September 20, 2024. https://data.ers.usda.gov/reports.aspx?ID=17833#P1b74a51ed69b464e8c7e7331f754daf7_2_118iT0R0x29