The Craft Beverages brief lays out the challenges and opportunities that impact the economically viable production of New Hampshire grown and processed beverages, including beer, wine, cider, kombucha, and spirits. The brief is one of 27 briefs created as part of the NH Food and Agriculture Strategic Plan.

What's at Stake?

Craft beverage producers contribute to the character and culture of New Hampshire. They create beautiful community spaces and unique local products, attractive to both tourists and residents alike. As the craft beverage market becomes increasingly crowded and competitive, and small New Hampshire farmers continue to struggle to sustain profitability, a collaborative opportunity arises: New Hampshire’s farmers and craft beverage producers can work together to increase awareness and drive profitability by crafting beverages with New Hampshire grown ingredients. With backing from the state, challenges related to regulation, equipment, and distribution can be mitigated, and craft beverage producers can become an increasingly important part of New Hampshire’s economy and food system.

Current Conditions

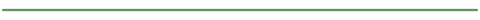

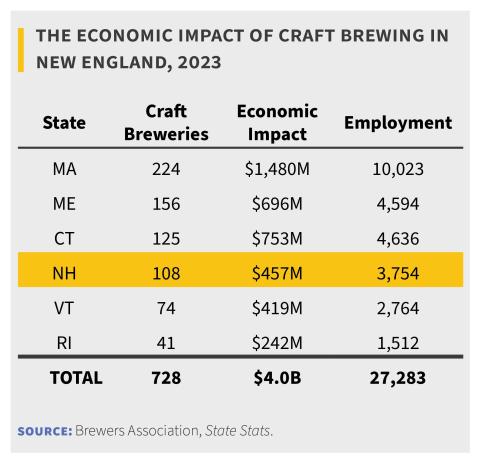

Despite dramatic growth in the New Hampshire craft beverage industry over the past 14 years, the market is retracting; the state has lost 22 craft brewers since 2022 and 43 since 2011.1

The challenging market conditions are based on a number of factors: the cost of running a business has increased dramatically since the pandemic, alcohol consumption is decreasing due to healthier lifestyle trends and lower-calorie substitutes, such as THC beverages, and producers aspiring to source local ingredients face challenges of limited supply, higher prices, climate instability, and difficult logistics.

In addition, bureaucracy and differing regulations across municipalities create a challenging landscape for craft beverage producers to operate. In order to sell more than one full glass of product, operators must offer food.2 As a result, many craft beverage manufacturers grapple with the additional regulations, challenges, and low margins of running a restaurant, including learning a new industry: hospitality. In addition, potential “low hanging fruit” revenue streams for our state’s small craft manufacturers, such as selling full pours directly at third party events, requires an additional license and fee. Further compounding the issue is the inconsistent interpretation and enforcement of regulations from town to town.

Finally, New Hampshire lacks a strong brand identity, which limits the ability of New Hampshire businesses to market to consumers. The state is also unique in owning state liquor stores, which do not currently sell beer or kombucha.

Challenges

> New Hampshire legislation is financially and administratively hamstringing beverage producers, the majority of which are small businesses.

- Laws across municipalities are interpreted differently, causing confusion.

- The three-tier system, often criticized for facilitating markups, is often the only way small producers can get their products into the state’s large grocery chains and chain restaurants.

- Tourism and other revenue-generating opportunities related to cannabis-derived beverages are illegal.

> New Hampshire state liquor stores do not sell craft beer, which is confusing to out-of-state customers and inconvenient for New Hampshire consumers.

> The rising cost of ingredients and labor, the growth in alternative beverages and “better for you” substitutes, and the explosion in competitive brands have resulted in shrinking margins, making it harder for smaller craft beverage businesses to prioritize using locally grown inputs.3

Opportunities

> Many small craft beverage producers in New Hampshire are supported by loyal customers excited to try new products, such as innovative, locally-sourced beverages that represent New Hampshire’s terroir. These adventurous consumers love novelty and seek out “rare” beers.4

> THC beverages are one of the fastest growing segments of the market and there is increasing interest from breweries. The infrastructure for production is already in place, which could offset dwindling sales and fill tank space in larger contract breweries. Opening this multi-billion dollar opportunity for cannabis beverages, with a projected 57.5% Compound Annual Growth Rate (CAGR)5, can help small farmers and craft beverage producers generate additional, much-needed revenue streams.

Recommendations

Organizations working on this issue

is an organization or program missing from this list? Let us know.

Authors

Lead Author

Nicole Carrier, Co-Founder & President, Throwback Brewery and Hobbs Farm

Contributing Authors

CJ Haines, Executive Director, New Hampshire Brewers Association

Helen Leavitt, Founder/CEO, Auspicious Brew

Brian Ferguson, Proprietor, Distiller/Winemaker, Flag Hill Distillery and Winery

This Craft Beverages brief was developed through a participatory process led by the NH Food Alliance, a program of the University of New Hampshire. The brief content is comprised of the opinions, perspectives, and information gathered by the authors and participants, and does not necessarily represent those of the NH Department of Agriculture, Markets, and Food or the NH Food Alliance.

Head to the NH Food and Agriculture Strategic Plan main page to read more briefs, browse recommendations and learn how the strategic plan was created.

References

1 Analysis from the NH Brewers Association

2 NH Liquor Commission, Division of Enforcement. Type of Licenses (RSA 178). SB 418 became part of the RSA 178 during the 2018 state legislative session. https://www.nh.gov/liquor/enforcement/licensing/license-types.htm; https://www.nh.gov/liquor/enforcement/documents/faq-sample-serve-product.pdf

3 Gatza P, Watson B. Overview: Carving a Path Back to Growth. Industry Review Issue: The New Brewer. Published May/June 2024. https://mydigitalpublication.com/publication/?m=22714&i=821835&p=42&ver=html5

4 Long J. Velikova N. Dodd T. Scott-Halsell S. International Journal of Hospitality and Beverage Management. Craft Beer Consumers' Lifestyles and Perceptions of Locality. Published October 22, 2019. https://dx.doi.org/10.34051/j/2019.5

5 Fortune Business Insights. Cannabis Beverages Market Size, Share & Industry Analysis, By Type (Alcoholic and Non-alcoholic), Distribution Channel (Mass Merchandisers, Specialty Stores, Online Retail, and Others), and Regional Forecast, 2024-2032. Fortunebusinessinsights.com. Updated October 7, 2024. Accessed October 17, 2024. https://www.fortunebusinessinsights.com/industry-reports/cannabis-beverages-market-100738